How Distributed Sensor Networks Are Revolutionizing Autonomous Undersea Navigation in 2025: Market Growth, Innovations, and the Next Wave of Ocean Intelligence

- Executive Summary: 2025 Snapshot and Key Takeaways

- Market Size, Growth Rate, and Forecasts Through 2030

- Core Technologies: Sensors, Communication, and AI Integration

- Key Industry Players and Strategic Partnerships

- Applications: Defense, Research, Energy, and Environmental Monitoring

- Challenges: Connectivity, Power Management, and Data Security

- Recent Breakthroughs and Case Studies (2023–2025)

- Regulatory Landscape and Industry Standards (e.g., IEEE, NATO)

- Investment Trends and Funding Landscape

- Future Outlook: Emerging Opportunities and Predicted Disruptions

- Sources & References

Executive Summary: 2025 Snapshot and Key Takeaways

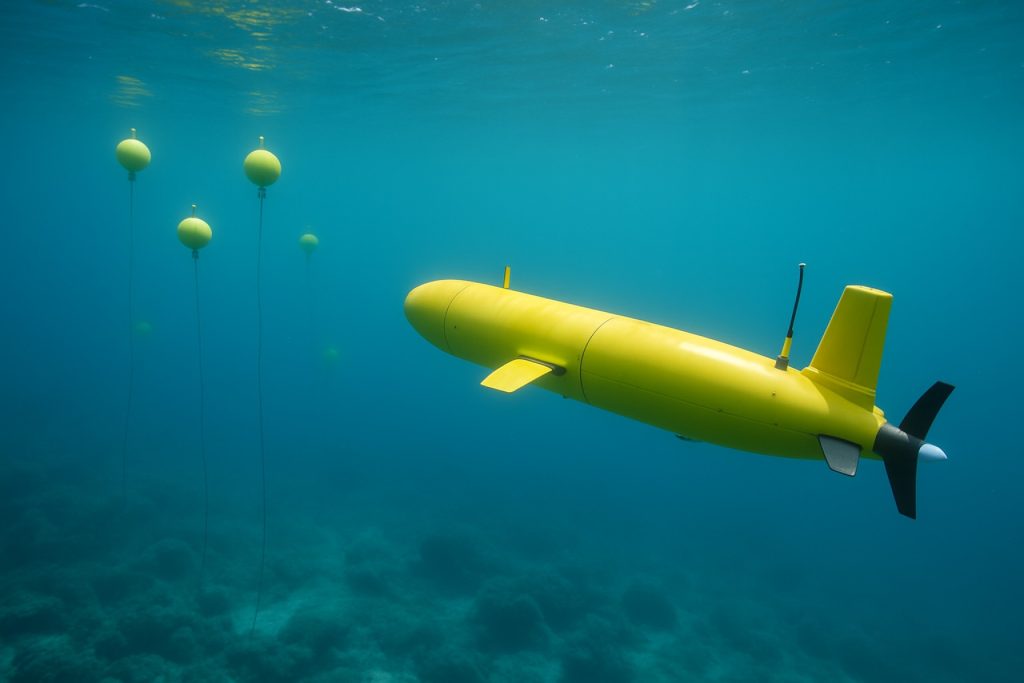

In 2025, distributed sensor networks are rapidly transforming autonomous undersea navigation, enabling unprecedented levels of situational awareness, reliability, and mission flexibility for both commercial and defense applications. These networks, composed of spatially dispersed sensor nodes—such as sonar arrays, acoustic modems, and environmental sensors—facilitate real-time data sharing and collaborative decision-making among autonomous underwater vehicles (AUVs) and unmanned underwater vehicles (UUVs). The integration of distributed sensor networks is addressing longstanding challenges in underwater navigation, including limited GPS availability, complex oceanographic conditions, and the need for stealth in military operations.

Key industry players are driving innovation in this space. Kongsberg Gruppen, a global leader in maritime technology, continues to advance its HUGIN AUV series with enhanced sensor fusion and networked communication capabilities, supporting deep-sea exploration and subsea infrastructure inspection. Saab AB is expanding its Seaeye range of underwater vehicles, integrating distributed sensor architectures for improved autonomy and multi-vehicle coordination. Teledyne Marine is leveraging its expertise in acoustic communication and sensor integration to enable robust, scalable undersea sensor networks, supporting both scientific and defense missions.

Recent deployments and pilot projects underscore the momentum in this sector. In 2024, collaborative trials involving multiple AUVs equipped with distributed sensor payloads demonstrated successful real-time mapping and navigation in complex littoral environments. These trials, often conducted in partnership with naval research organizations and energy companies, highlight the operational benefits of distributed sensing—such as redundancy, adaptive mission planning, and resilience to single-point failures.

Looking ahead, the next few years will see further convergence of distributed sensor networks with advances in edge computing, artificial intelligence, and secure underwater communications. Industry roadmaps indicate a shift toward open-architecture systems, enabling interoperability between platforms from different manufacturers. This is expected to accelerate adoption in both commercial sectors—such as offshore energy, environmental monitoring, and undersea cable inspection—and defense, where multi-domain operations and persistent undersea surveillance are strategic priorities.

In summary, 2025 marks a pivotal year for distributed sensor networks in autonomous undersea navigation. The sector is characterized by rapid technological progress, expanding operational deployments, and growing collaboration between industry leaders like Kongsberg Gruppen, Saab AB, and Teledyne Marine. The outlook for the coming years is defined by increased autonomy, interoperability, and mission effectiveness across a broadening range of undersea applications.

Market Size, Growth Rate, and Forecasts Through 2030

The market for distributed sensor networks (DSNs) in autonomous undersea navigation is experiencing robust growth, driven by increasing demand for advanced underwater exploration, defense applications, and offshore energy operations. As of 2025, the global market size for DSNs tailored to undersea navigation is estimated to be in the low single-digit billions (USD), with projections indicating a compound annual growth rate (CAGR) of approximately 12–15% through 2030. This growth is underpinned by rapid advancements in sensor miniaturization, energy-efficient communication protocols, and the integration of artificial intelligence for real-time data processing.

Key industry players such as Kongsberg Gruppen, a Norwegian technology leader, and Teledyne Technologies, a major US-based provider of marine instrumentation, are at the forefront of deploying distributed sensor arrays for autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs). These companies are investing heavily in R&D to enhance the reliability and scalability of DSNs, enabling more precise navigation and situational awareness in complex subsea environments.

The defense sector remains a primary driver, with navies worldwide—particularly in the US, Europe, and Asia-Pacific—expanding their fleets of autonomous undersea platforms equipped with distributed sensor networks. For example, Leonardo S.p.A. and Saab AB are actively developing integrated sensor solutions for military-grade AUVs, supporting missions such as mine countermeasures, surveillance, and anti-submarine warfare. The commercial sector is also contributing to market expansion, with offshore energy companies deploying DSNs for pipeline inspection, environmental monitoring, and resource mapping.

Recent years have seen a surge in collaborative projects and public-private partnerships aimed at standardizing communication protocols and data interoperability for undersea sensor networks. Organizations such as NATO and Ocean Observatories Initiative are facilitating the development of open architectures, which is expected to accelerate adoption and lower integration costs.

Looking ahead to 2030, the market outlook remains highly positive. The proliferation of autonomous undersea vehicles, combined with the need for persistent, wide-area situational awareness, will continue to drive investment in distributed sensor networks. Technological breakthroughs in underwater wireless communication and energy harvesting are anticipated to further expand the operational capabilities and market reach of DSNs, solidifying their role as a foundational technology for the next generation of autonomous undersea navigation systems.

Core Technologies: Sensors, Communication, and AI Integration

Distributed sensor networks are rapidly transforming autonomous undersea navigation, leveraging advances in sensor miniaturization, robust underwater communication, and artificial intelligence (AI) integration. As of 2025, these networks are enabling fleets of autonomous underwater vehicles (AUVs) and unmanned underwater vehicles (UUVs) to collaboratively map, monitor, and navigate complex marine environments with unprecedented precision and resilience.

Core sensor technologies in these networks include high-resolution sonar, Doppler velocity logs (DVL), inertial measurement units (IMU), and environmental sensors for salinity, temperature, and pressure. Companies such as Kongsberg Gruppen and Teledyne Marine are at the forefront, supplying advanced sonar and navigation payloads for distributed AUV operations. These sensors are increasingly networked, allowing multiple vehicles to share real-time data and collectively build detailed situational awareness, even in GPS-denied environments.

Communication remains a central challenge for undersea networks due to the limitations of radio frequency propagation underwater. In 2025, acoustic modems are the primary means of inter-vehicle communication, with companies like EvoLogics and Sonardyne International providing robust, low-latency acoustic networking solutions. Recent developments focus on adaptive networking protocols and mesh architectures, enabling dynamic reconfiguration and resilience to node failures or environmental disruptions. Optical and even magnetic induction communication are being explored for short-range, high-bandwidth links, but acoustic remains dominant for distributed operations.

AI integration is accelerating the autonomy and efficiency of distributed sensor networks. Onboard AI algorithms process sensor data locally, enabling real-time decision-making, adaptive mission planning, and collaborative behaviors among multiple vehicles. Saab AB and L3Harris Technologies are actively developing AI-driven autonomy suites for their AUV platforms, focusing on swarm coordination, anomaly detection, and energy optimization. These systems can autonomously re-task vehicles in response to new data, improving mission outcomes and reducing operator workload.

Looking ahead, the next few years will see further miniaturization of sensors, increased onboard processing power, and the adoption of hybrid communication systems. Standardization efforts by industry bodies such as the IEEE are expected to facilitate interoperability between heterogeneous platforms. As distributed sensor networks mature, they will underpin applications ranging from deep-sea exploration and infrastructure inspection to environmental monitoring and maritime security, driving a new era of autonomous undersea operations.

Key Industry Players and Strategic Partnerships

The landscape of distributed sensor networks for autonomous undersea navigation is rapidly evolving, with several key industry players and strategic partnerships shaping the sector as of 2025. These collaborations are driving advancements in sensor integration, data fusion, and real-time underwater navigation capabilities, which are critical for both commercial and defense applications.

A leading force in this domain is Kongsberg Gruppen, a Norwegian technology company renowned for its maritime and defense solutions. Kongsberg has been at the forefront of developing autonomous underwater vehicles (AUVs) and integrated sensor suites, leveraging distributed acoustic, inertial, and environmental sensors to enhance navigation accuracy in GPS-denied environments. Their HUGIN AUV series, for example, incorporates advanced sensor fusion and real-time data sharing across networked platforms, enabling collaborative missions and persistent undersea surveillance.

Another significant player is Teledyne Technologies, a US-based conglomerate with a strong portfolio in marine instrumentation and sensor networks. Teledyne’s distributed sensor systems are widely deployed for oceanographic research, offshore energy, and defense, offering modularity and interoperability for multi-vehicle operations. In recent years, Teledyne has expanded its partnerships with naval organizations and research institutes to develop next-generation distributed navigation solutions, focusing on robust communication protocols and adaptive mission planning.

In the Asia-Pacific region, Mitsubishi Electric has emerged as a key innovator, investing in distributed sensor arrays and AI-driven navigation algorithms for undersea robotics. Mitsubishi’s collaborations with Japanese maritime agencies and academic institutions are accelerating the deployment of networked AUVs for deep-sea exploration and infrastructure inspection, with a focus on reliability and scalability.

Strategic partnerships are also central to the sector’s progress. For instance, Saab AB—a Swedish defense and security company—has established joint ventures with European navies and technology firms to co-develop distributed sensor platforms for mine countermeasures and autonomous patrol missions. Saab’s Sea Wasp and Sabertooth vehicles exemplify the integration of distributed sensing and autonomous navigation in operational settings.

Looking ahead, the next few years are expected to see intensified collaboration between industry leaders, defense agencies, and research organizations. Initiatives such as open-architecture sensor networks and standardized communication frameworks are gaining traction, aiming to facilitate interoperability and rapid technology adoption. As distributed sensor networks become more sophisticated, the sector is poised for breakthroughs in swarm navigation, real-time environmental adaptation, and long-duration autonomous missions, with key players like Kongsberg, Teledyne, Mitsubishi Electric, and Saab driving innovation and shaping the global competitive landscape.

Applications: Defense, Research, Energy, and Environmental Monitoring

Distributed sensor networks are rapidly transforming autonomous undersea navigation, with significant applications across defense, scientific research, energy, and environmental monitoring. As of 2025, these networks—comprising interconnected nodes such as sonar buoys, underwater vehicles, and seabed sensors—enable real-time data sharing, situational awareness, and adaptive mission planning in complex marine environments.

In the defense sector, navies are deploying distributed sensor networks to enhance anti-submarine warfare, mine detection, and maritime domain awareness. The U.S. Navy’s efforts, for example, include the integration of autonomous underwater vehicles (AUVs) and fixed sensor arrays for persistent surveillance and navigation in contested waters. Companies like Lockheed Martin and Northrop Grumman are developing advanced AUVs and networked sensor solutions, focusing on interoperability and secure communications. The UK’s Royal Navy and France’s Naval Group are also investing in distributed undersea sensor grids to support autonomous navigation and threat detection.

For scientific research, distributed sensor networks are revolutionizing oceanography and marine biology. Networks of autonomous gliders and floats, such as those supported by Teledyne Marine and Kongsberg Maritime, provide high-resolution, real-time data on ocean currents, temperature, salinity, and biogeochemical parameters. These data streams are critical for climate modeling, ecosystem monitoring, and understanding the impacts of climate change on marine environments. The Monterey Bay Aquarium Research Institute (MBARI) continues to pioneer distributed sensor deployments for deep-sea exploration and long-term environmental monitoring.

In the energy sector, offshore oil and gas operators are leveraging distributed sensor networks for subsea infrastructure monitoring, leak detection, and autonomous inspection. Companies such as Saab and Fugro are deploying AUVs and sensor arrays to map pipelines, monitor structural integrity, and optimize maintenance. These systems reduce operational risks and costs while enabling safer, more efficient exploration and production in deepwater environments.

Environmental monitoring is another critical application. Distributed sensor networks are used to track pollution, monitor harmful algal blooms, and assess the health of coral reefs and fisheries. Organizations like Woods Hole Oceanographic Institution and Scripps Institution of Oceanography are deploying sensor-equipped AUVs and moored observatories to collect continuous environmental data, supporting conservation and regulatory compliance.

Looking ahead, advances in edge computing, AI-driven data fusion, and underwater wireless communications are expected to further enhance the autonomy, resilience, and scalability of distributed sensor networks. As these technologies mature, their adoption across defense, research, energy, and environmental sectors is set to accelerate, driving new capabilities in autonomous undersea navigation through 2025 and beyond.

Challenges: Connectivity, Power Management, and Data Security

Distributed sensor networks are pivotal for enabling autonomous undersea navigation, but their deployment faces significant challenges in connectivity, power management, and data security—issues that are especially acute in the harsh and unpredictable marine environment. As of 2025, these challenges are shaping the pace and direction of technological progress in both commercial and defense sectors.

Connectivity remains a primary hurdle. Underwater, radio frequency (RF) signals attenuate rapidly, making traditional wireless communication infeasible. Acoustic communication is the prevailing method, but it suffers from low bandwidth, high latency, and susceptibility to noise and multipath effects. Companies such as Kongsberg Gruppen and Teledyne Marine are actively developing advanced acoustic modems and networking protocols to improve reliability and range. Recent field trials by Kongsberg Gruppen have demonstrated mesh networking capabilities that allow autonomous underwater vehicles (AUVs) to relay data across larger distances, but real-time, high-throughput communication remains elusive. Optical and magnetic induction methods are being explored for short-range, high-speed links, but their practical deployment is still limited to specific scenarios.

Power management is another critical constraint. Undersea sensor nodes and AUVs are typically battery-powered, and recharging or replacing batteries underwater is logistically complex and costly. Innovations in energy harvesting—such as exploiting ocean currents, thermal gradients, or microbial fuel cells—are being pursued by organizations like Woods Hole Oceanographic Institution and Saab AB. However, as of 2025, most operational systems still rely on high-density lithium batteries, with incremental improvements in energy efficiency and power-aware networking protocols. The development of docking stations for AUVs, as seen in projects by Saab AB, offers some promise for in-situ recharging, but widespread adoption is pending further reliability and cost reductions.

Data security is increasingly critical as distributed sensor networks become more interconnected and autonomous. The risk of data interception, spoofing, or malicious interference is heightened by the open and often unmonitored nature of the marine environment. Industry leaders such as Leonardo S.p.A. and Thales Group are integrating encryption and authentication protocols tailored for low-bandwidth, high-latency underwater links. However, balancing robust security with the limited computational and energy resources of underwater nodes remains a technical challenge.

Looking ahead, the next few years are expected to bring incremental advances rather than breakthroughs. The focus will likely remain on hybrid communication architectures, improved energy harvesting, and lightweight security solutions. Collaboration between industry, academia, and defense agencies will be essential to address these persistent challenges and unlock the full potential of distributed sensor networks for autonomous undersea navigation.

Recent Breakthroughs and Case Studies (2023–2025)

Between 2023 and 2025, distributed sensor networks (DSNs) for autonomous undersea navigation have seen significant breakthroughs, driven by advances in sensor miniaturization, underwater communication, and collaborative autonomy. These developments are reshaping the capabilities of autonomous underwater vehicles (AUVs) and enabling new mission profiles in both commercial and defense sectors.

A major milestone was achieved in 2023 when Kongsberg Gruppen, a global leader in maritime technology, successfully demonstrated a swarm of AUVs using a distributed acoustic sensor network for coordinated seabed mapping. The system leveraged real-time data sharing between vehicles, allowing for adaptive mission planning and improved coverage in complex environments. This approach reduced mission time and increased data fidelity, setting a new standard for multi-vehicle operations.

In 2024, Saab AB advanced the field with its Sabertooth AUVs, integrating distributed sonar and inertial navigation sensors. These vehicles operated collaboratively to inspect subsea infrastructure, such as pipelines and cables, in the North Sea. The distributed network enabled the AUVs to maintain precise positioning even in GPS-denied environments, a critical requirement for deepwater operations. Saab’s work demonstrated the commercial viability of DSNs for long-duration, autonomous inspection missions.

On the defense front, Northrop Grumman Corporation and Lockheed Martin Corporation have both reported progress in distributed undersea sensor networks for persistent surveillance and mine countermeasures. Their systems employ a combination of fixed and mobile nodes, using acoustic and optical links to relay information across large areas. These networks are designed to detect, classify, and track underwater threats autonomously, with recent sea trials validating their effectiveness in contested environments.

A notable case study from 2025 involves Thales Group, which deployed a distributed network of low-power, battery-operated sensors for environmental monitoring in the Mediterranean. The network provided continuous, high-resolution data on water quality and marine life, supporting both scientific research and regulatory compliance. Thales’ solution highlighted the potential for scalable, energy-efficient DSNs in long-term ocean observation.

Looking ahead, the outlook for distributed sensor networks in undersea navigation is robust. Industry leaders are investing in AI-driven sensor fusion, improved underwater wireless communication, and energy harvesting technologies to extend mission duration and autonomy. As these systems mature, they are expected to enable new applications in resource exploration, environmental monitoring, and maritime security, with widespread adoption anticipated by the late 2020s.

Regulatory Landscape and Industry Standards (e.g., IEEE, NATO)

The regulatory landscape and industry standards for distributed sensor networks in autonomous undersea navigation are rapidly evolving as the technology matures and deployment scales up in 2025. The sector is shaped by a combination of international standards bodies, defense alliances, and industry consortia, each addressing the unique challenges of underwater communication, interoperability, and safety.

A cornerstone of technical standardization is the work of the IEEE, which has developed and continues to update standards relevant to underwater sensor networks. The IEEE 1906.1 standard, for example, provides a framework for nanoscale and molecular communication, which is increasingly relevant as sensor nodes become smaller and more energy-efficient. The IEEE Oceanic Engineering Society also supports working groups focused on interoperability and data exchange protocols for undersea sensor networks, with new guidelines expected to be published in the next two years.

On the defense and security front, NATO plays a pivotal role in harmonizing requirements and operational standards among member states. NATO’s Undersea Research Centre (NURC) and the NATO Science and Technology Organization (STO) have issued recommendations for secure, resilient, and interoperable distributed sensor networks, particularly for anti-submarine warfare and maritime situational awareness. In 2024, NATO initiated new collaborative projects to test multi-nation sensor network interoperability, with results expected to inform updated alliance-wide standards by 2026.

The International Organization for Standardization (ISO) is also active, with technical committees such as ISO/TC 8 (Ships and marine technology) and ISO/IEC JTC 1 (Information technology) working on standards for underwater communication protocols, data formats, and cybersecurity. These efforts are increasingly coordinated with the International Electrotechnical Commission (IEC), reflecting the convergence of IT and operational technology in modern undersea systems.

Industry consortia and leading manufacturers are contributing to the standards process. Companies like Kongsberg Gruppen and Teledyne Technologies are active in both standards development and field trials, often collaborating with navies and research institutions to validate interoperability and safety requirements. These companies are also driving the adoption of open architectures and modular sensor interfaces, which are expected to become baseline requirements in procurement specifications by 2027.

Looking ahead, regulatory focus is expected to intensify on cybersecurity, spectrum management, and environmental impact. The increasing use of distributed sensor networks for both civilian and defense applications is prompting calls for unified certification schemes and cross-border data governance frameworks. As the technology landscape evolves, the interplay between regulatory bodies, industry leaders, and international alliances will be critical in shaping safe, secure, and interoperable undersea navigation systems.

Investment Trends and Funding Landscape

The investment landscape for distributed sensor networks (DSNs) in autonomous undersea navigation is experiencing significant momentum in 2025, driven by the convergence of defense, commercial, and scientific interests. The global push for maritime security, offshore resource exploration, and environmental monitoring has catalyzed both public and private sector funding into advanced undersea sensing technologies.

Major defense agencies remain the primary investors in DSN technologies for undersea navigation. The United States Navy continues to allocate substantial budgets to the development and deployment of distributed sensor arrays and autonomous underwater vehicles (AUVs), focusing on persistent surveillance, mine countermeasures, and anti-submarine warfare. In 2024, the U.S. Department of Defense announced increased funding for programs integrating AI-driven sensor fusion and resilient underwater communication networks, with several contracts awarded to leading defense contractors and technology firms.

On the commercial side, energy companies such as Shell and Equinor are investing in DSN-enabled AUVs for subsea infrastructure inspection and pipeline monitoring. These investments are motivated by the need for cost-effective, high-resolution mapping and real-time anomaly detection in challenging deepwater environments. The offshore wind sector is also emerging as a significant investor, seeking to leverage distributed sensor networks for cable route surveys and environmental impact assessments.

Venture capital and corporate venture arms are increasingly active in the DSN space. Startups specializing in underwater robotics, edge computing, and low-power sensor nodes have attracted multi-million dollar seed and Series A rounds since 2023. Notable examples include companies developing modular sensor platforms and mesh networking solutions for scalable, autonomous undersea operations. Strategic partnerships between established marine technology firms such as Kongsberg Gruppen and innovative startups are accelerating the commercialization of DSN technologies.

Government research organizations, including the National Aeronautics and Space Administration (NASA) and the National Oceanography Centre in the UK, are channeling grants into collaborative projects that advance distributed sensing for oceanographic research and planetary analog missions. These initiatives often involve international consortia, reflecting the global nature of undersea navigation challenges.

Looking ahead, the funding landscape is expected to remain robust through the late 2020s, with increased cross-sector collaboration and dual-use technology development. The growing emphasis on autonomy, resilience, and data-driven decision-making in undersea operations will likely sustain high levels of investment, particularly as new applications in climate monitoring and subsea communications emerge.

Future Outlook: Emerging Opportunities and Predicted Disruptions

The future of distributed sensor networks for autonomous undersea navigation is poised for significant transformation in 2025 and the years immediately following. As the demand for persistent, reliable, and intelligent undersea navigation grows—driven by defense, scientific, and commercial interests—several emerging opportunities and potential disruptions are coming into focus.

One of the most prominent trends is the integration of advanced edge computing and artificial intelligence (AI) directly into sensor nodes. This shift enables real-time data processing and decision-making at the network edge, reducing latency and dependence on intermittent surface communications. Companies such as Kongsberg Gruppen and Teledyne Marine are actively developing next-generation autonomous underwater vehicles (AUVs) and sensor platforms that leverage onboard AI for adaptive navigation and environmental awareness.

Another key development is the move toward interoperability and standardization of sensor networks. Industry consortia and organizations, including the NATO Centre for Maritime Research and Experimentation, are working to establish common protocols and interfaces, enabling heterogeneous fleets of AUVs and static sensors to collaborate seamlessly. This is expected to accelerate multi-vendor deployments and foster innovation in both hardware and software.

Energy autonomy remains a critical challenge and opportunity. Recent advances in underwater wireless power transfer and energy harvesting—such as those being explored by Saab AB and Lockheed Martin—promise to extend mission durations and reduce the need for costly retrieval and redeployment of sensor assets. These technologies are likely to see pilot deployments in 2025, with broader adoption anticipated as reliability improves.

The proliferation of distributed sensor networks is also expected to disrupt traditional undersea navigation paradigms. Instead of relying solely on inertial navigation or sporadic GPS surfacing, future AUVs will increasingly use collaborative localization, where swarms of vehicles and fixed nodes share positioning data to maintain accurate navigation even in GPS-denied environments. This approach is being trialed in joint projects by Thales Group and Leonardo S.p.A., with initial operational capabilities projected within the next few years.

Looking ahead, the convergence of distributed sensing, AI, and energy innovation is set to unlock new applications—from persistent oceanographic monitoring to autonomous subsea infrastructure inspection and defense surveillance. As these technologies mature, the undersea domain will become more accessible, intelligent, and resilient, reshaping both commercial and strategic operations beneath the waves.

Sources & References

- Kongsberg Gruppen

- Saab AB

- Teledyne Marine

- Teledyne Technologies

- Leonardo S.p.A.

- L3Harris Technologies

- IEEE

- Mitsubishi Electric

- Lockheed Martin

- Northrop Grumman

- Monterey Bay Aquarium Research Institute

- Fugro

- Leonardo S.p.A.

- Thales Group

- ISO

- Shell

- Equinor

- National Aeronautics and Space Administration (NASA)

- National Oceanography Centre

More Stories

High-Resolution SAR Imaging Market Surge: Radar Vision’s Expanding Role

Boise Housing Surge: Price Hikes, Rental Demand & Analyst Insights

Satellite Imagery Insights: Core Principles, Key Uses, and Emerging Trends